Smaller pieces of land can actually cost more on a per-square-meter basis than larger plots.

This paradoxical trend is particularly pronounced in certain areas of Nairobi, such as Parklands, Riverside, Upperhill, Westlands, and Kileleshwa, as reported by HassConsult’s Q2 Land Indexes. For instance, in these neighborhoods, a three-quarters acre of land can be valued higher than an acre.

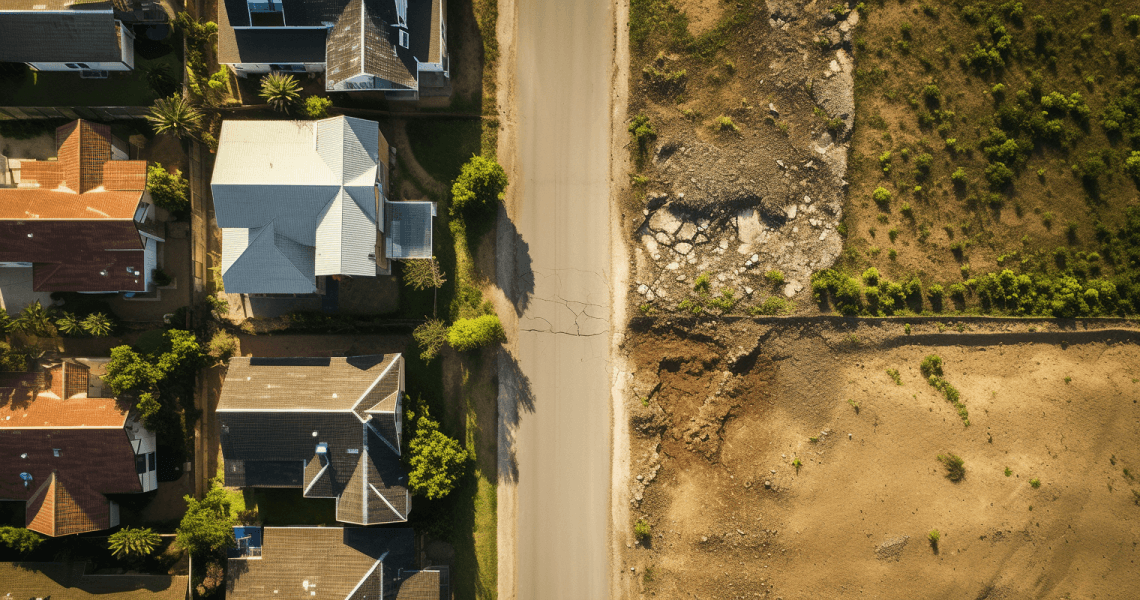

In Nairobi, the real estate market is a dynamic and complex landscape where the cost of land varies considerably based on numerous factors.

Reasons Why Smaller Pieces of Land Cost More

Here are some key reasons why smaller pieces of land come with a higher price tag in Nairobi:

Table of Contents

High Demand for Limited Space

Nairobi is the capital city of Kenya and the economic hub of East Africa. It attracts people from across the country and the continent due to its job opportunities, education centers, and vibrant culture. With a growing population and urbanization, the demand for land in Nairobi is exceptionally high. Smaller parcels of land are often more readily available, and their scarcity drives up their value.

Location Matters

The location of a piece of land is a primary determinant of its price. Smaller plots of land in prime or well-developed areas within Nairobi tend to be more expensive because they offer easy access to essential amenities, transportation networks, and a better quality of life. These locations are often close to business districts, schools, hospitals, and shopping centers, making them highly desirable.

Development Costs

Smaller plots of land can sometimes come with higher development costs per square meter. When constructing on a small piece of land, there might be less room for efficient design and layout, necessitating creative architectural solutions that can be more expensive.

Additionally, infrastructure costs, like water and electricity connections, might be similar for small and large plots, making the cost per square meter higher for smaller land.

Investment Potential

Smaller plots of land can be attractive to investors looking for opportunities to develop compact, high-rise buildings. The potential for rental income or resale value often drives up the prices of smaller parcels, as they can yield a significant return on investment.

READ ALSO: How to Calculate Return on Investment on Your Rental Unit

Zoning Regulations

Zoning laws and regulations set by local authorities can also impact land prices. In some cases, smaller plots might be zoned for specific high-density developments, allowing for more units per square meter. This zoning can increase the land’s overall value.

Limited Subdivision Options

Nairobi’s land market also faces constraints related to land subdivisions. The process of subdividing larger pieces of land into smaller plots can be time-consuming and costly, often requiring adherence to strict regulations. This limitation on subdivision options can make smaller plots relatively more expensive.

Sakina Hassanali, Head of Development, Consulting, and Research at HassConsult, notes that land pricing is influenced by development potential and density guidelines. Areas with less rigidity around development densities tend to see increased land pricing in tandem with approved density.

Upperhill holds the record for the most expensive acre of land in Nairobi, valued at Ksh478 million, followed by Westlands at Ksh452 million. Other highly valued areas include Parklands, Kilimani, Riverside, Kileleshwa, Gigiri, Lavington, Muthaiga, and Nyari.

READ ALSO: Nairobi’s Property Market Outpaces London in Price Growth

In Nairobi’s competitive real estate landscape, the cost of land is influenced by various factors, making smaller land parcels more expensive per square meter than their larger counterparts. Understanding these dynamics is essential for anyone looking to invest in Nairobi’s real estate market.

Conclusion

The higher cost of smaller pieces of land in Nairobi is a result of various factors, including high demand, location, development costs, investment potential, zoning regulations, subdivision limitations, and land speculation. As the city continues to grow and evolve, understanding these dynamics is essential for anyone considering property investment in Nairobi.