- 33.2% of Sacco loans in 2022 were for land and homeownership

- The percentage the previous year (2021) was 26.9%

- 680.4 billion shillings was lended by a total of 359 regulated Saccos

In a recent report released by the Sacco Societies Regulatory Authority (SASRA) for the year 2022, it was disclosed that land purchases and homeownership plans collectively represented a significant portion of the fresh credit disbursed by savings and credit cooperative societies (Saccos) during the same year.

Table of Contents

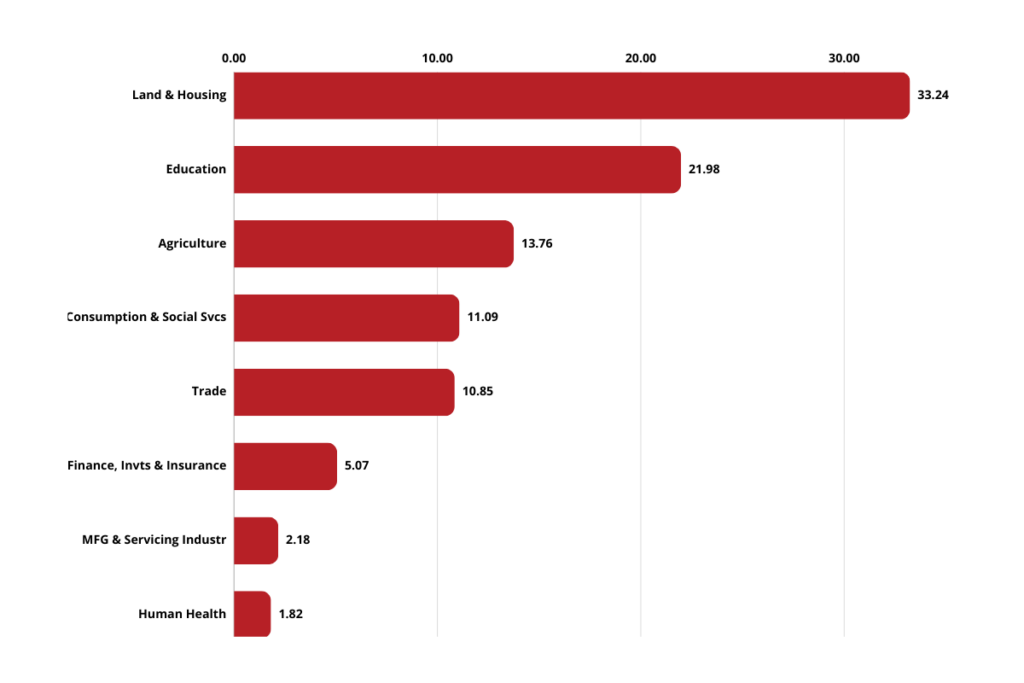

Saccos’ lending allocation across various sectors

The data outlined in the report revealed that loans associated with land and housing constituted a substantial 33.2 percent of the total new loans issued by Saccos in 2022.

The increase from 26.9 percent in 2021 to the current 33.2 percent signifies the determined efforts of Saccos to empower its members in the pursuit of land and homeownership.

This preference for land and housing loans stems from Saccos adopting an incremental mortgage lending model, setting them apart from the traditional mortgage approach used by commercial banks.

In a similar article published by Timothy Odinga in The Business Daily, he noted that the incremental lending model revolves around short-term credit facilities, typically spanning three to five years, allowing Saccos to efficiently manage liquidity and mitigate risk.

READ ALSO: What is the Best Way to Finance Land in Kenya? (Sacco, Bank)

Enrollment within Deposit-taking Saccos

Additionally, SASRA’s report acknowledges the role played by the Kenya Mortgage Refinance Company, which has partnered with select institutions, further boosting lending towards housing initiatives. Notably, lending for education purposes also saw an increase, accounting for 22 percent of new credit last year, up from 20.8 percent in 2021.

However, there was a decline in the proportion of credit allocated to agriculture, Kenya’s largest economic sector, which contributes significantly to the country’s GDP. This drop, amounting to 3.7 percent, brought the proportion of lending to agriculture down to 13.76 percent. The decrease was attributed to erratic weather patterns, with Kenya experiencing one of the worst droughts in recent memory.

Savings and Credit Cooperative (SACCO) accepting deposits

According to the regulator’s report, Kenya boasts 359 regulated Saccos, with 176 of them classified as deposit-taking Saccos. Meanwhile, the number of Non-Withdrawable Deposit-taking Saccos decreased by two, bringing the total to 183.

Cumulatively, these financial institutions reported an impressive 11.8 percent growth in lending, reaching a total of Sh680.4 billion. This surpasses the previous year’s growth rate of 9.67 percent. Moreover, customer deposits in these institutions surged by 9.8 percent to Sh620.4 billion, bolstered by the country’s ongoing economic recovery from the pandemic.

The number of active members within deposit-taking Saccos also saw significant growth, expanding by 8.5 percent to reach 4.8 million. In total, Sacco membership increased to 6.4 million, highlighting the continued importance of these cooperative societies in Kenya’s financial landscape.