Investing in the Kenyan real estate market is a great way to secure your family’s future. It provides a steady income flow compared to other volatile investment options like shares.

But it doesn’t come without risks. Which, understandably, could be discouraging for any investor.

In this guide, we go through the eight crucial steps to help you get it right; from the research stage to renting out your property.

How to invest in property in Kenya

Table of Contents

1. Evaluating Your Investment Strategy

Vision is everything. Before you spend your money, have clarity on what your investment goals are. Not all properties will give you the same return.

Although there are various forms of real estate investment, the two major classifications are:

- Buying to resell for a profit

- Buying to rent

If you have the time to oversee construction changes, inspect site workers and go through the selling process, then buying and reselling is the best fit for you.

Otherwise, buying to rent is a better option as you have the potential of getting two types of return.

First, the value of the property appreciates in the long run due to improvements. It’s unlikely that you’ll have the property in the same state from one tenant to another.

You also increase the equity of the property by paying down the mortgage. As your mortgage balance declines, the property’s value rises overtime.

Most importantly, you have the potential to realise an ongoing return in positive cash flow in the form of monthly rental payments.

READ ALSO: How to Identify Real Estate Investment Opportunities- Kenya

2. Assessing the Type of Property to Invest In

Are you looking to buy a townhouse, vacation rental, student hostels or an apartment?

The property you invest in will affect your financing. For example, a vacation rental would be expensive because of the finishing compared to student housing that will be more simplistic with only essential fixtures and fitting.

Another factor to consider is the occupancy rate and flow of income. For example, a family home will attract longer-term renters. Families are perceived to be financially stable and able to pay rent regularly. On the other hand, student hostels could mean a regular change of tenants or dealing with those unable to pay rent.

It’s important to keep in mind that you will not be occupying the property. Put the needs of your target tenants above yours by focusing on what appeals to them.

Therefore, a perfect combination of valuable investment is finding a property that matches your investment strategy while fulfilling the needs of your potential tenants.

READ ALSO: Pros and Cons of Investing in Real Estate in Kenya

3. Researching Location

Finding the perfect location to invest in can be a minefield. The last thing you want is to be stuck with a rental property that no one is willing to occupy.

A perfect location would be one with high growth potential like satellite towns which are within a commutable distance to the Central Business District (CBD) like Ruaka. Your tenants will enjoy suburban life but still have access to all the action in the city.

And with access to infrastructure and conducive social amenities like a sound transport system, schools, the demand for your rental property will go up. You won’t need to worry about finding tenants.

Don’t forget to look at market saturation. If the neighbourhood has a lot of vacant houses, this could either signal a seasonal cycle or a neighbourhood decline. You can start by looking at the available property in the neighbourhood.

Most importantly, stay up to date with news to know about neighbourhoods with growing population and remodelling plans in the pipelines. This indicates an investment opportunity. An excellent place to start is reading the real estate weekly reports by Cytonn.

4. Evaluating Your Financing

Usually, investment properties will require a larger down payment compared to owner-occupied property. Your regular 3% down payment to own a home, will not cut it.

Most banks in Kenya will require an average of 20% – 30% of the value of the property as the down payment for an investment mortgage. To start you off, here’s a handy list of mortgage companies regulated by the Central Bank of Kenya.

But before you settle on which one, speak to a mortgage adviser to find out the range of options available. You want a bank that charges minimal interest and the shortest payback period. No one wants a mortgage payment plan that eats into their monthly profits!

The good news is it’s possible to get a lower interest rate or more money from your bank. But first, you need to prove your credit-worthiness and possibly bring lower quotes from different sources to give you a higher negotiating power.

Aside from the cost of acquiring the rental property, keep in mind other expenses that you need to cover before renting out the property. Additional costs that will not be covered by your financier include;

- Maintenance costs

- Agency fees

- Property purchase tax

- Closing costs; stamp duty and notary fees

Additionally, do not rely on your expenses to be covered within the first month. Make sure you have a financial cushion in the form of a reserve stashed away in your bank account.

READ ALSO: Mortgage Application Process in Kenya: Step-by-Step Guide

5. Working Out Expected Returns

How do you determine whether the rental property makes financial sense?

You can assess capital growth potential to understand whether the value of your property is likely to grow over time.

Study the average rental prices of similar properties in the area you want to invest in to get the estimated rental return and calculate the rental yield of your property.

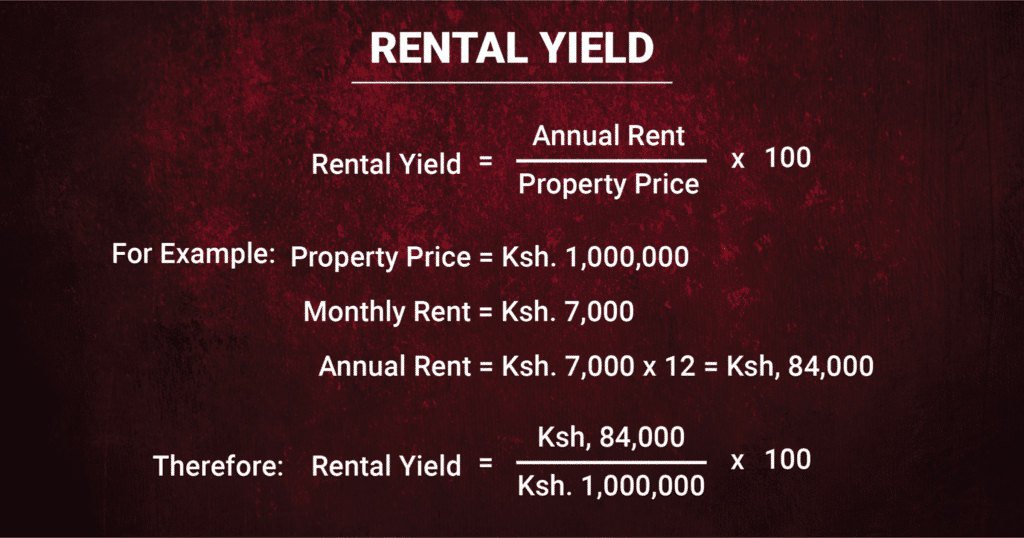

Rental yield is the percentage of estimated annual rental income divided by the cost of acquiring the property. You can use this figure to assess whether the rent you will receive can take care of the cost of maintaining the property, while still providing a profit.

Rental yield = (annual rental income / cost of acquiring property) x 100

Let’s look at an example:

A good rental yield is 7% and above. Compare your rental yield with other investment options like Government bonds, T-bills, money markets and shares in the Nairobi Stock Exchange (NSE) to weigh your options.

Additionally, ensure that you can afford to take care of the costs of maintenance when the rental property is empty. As a landlord, this is not something you can avoid as it could take days, weeks or even months to get a replacement when someone moves out.

That said, you can take care of this with proper risk management.

6. Managing Risks

As an investor, the only safety net for your potential problems is to ensure you have contingency plans in place to minimise risks.

Although landlord insurance is not mandatory under Kenyan Law, you’d be insane not to get covered. Insurance protects you against;

- Damage to the building fixtures and fittings

- Loss of property contents (for furnished apartments)

- Third-party liability

- Mortgage monthly instalment payment

To lower your costs, find out if your insurance provider can bundle up landlord insurance with homeowner insurance.

It’s also important to note that some banks will have insurance as a condition for financing your mortgage.

Finally, no one wants to be summoned to court by their tenants. Be familiar with the Kenyan landlord-tenant laws. Know your legal obligations regarding security deposits, eviction rules and lease requirements. The safest way to do this is to hire a lawyer to draw up and authenticate your Tenancy Agreements. Then, if possible, keep them on retainer to handle any other unforeseen legal matters.

7. Choosing a Tenant

A property is only profitable to you if it’s occupied. You can choose to market the property by yourself or use an agent to handle the process for you at a fee. The cost will depend on the agency but is a percentage of your rental income. Remax Kenya, for instance, charges 100% of the first month’s rent.

Whether you choose to do it by yourself or via an agent, it’s crucial to screen the tenants. You want someone who takes care of the place like their own and will pay their rent on time. Otherwise, you’ll spend most of your days chasing after them, which isn’t pleasant at all.

Request a copy of payslips and a work contract to prove their capability to pay the rent. An ideal tenant should have an income of thrice the rental price, consistent work history and a stable job.

Also, be on the lookout for criminal history. Ask your potential tenants for copies of a certificate of good conduct from the Kenya Police.

And if by any chance the tenant does not meet your requirements, it’s okay to pick someone else. Just ensure your decision isn’t based on tribal or any other segregation, or else, you will be opening up yourself to potential lawsuits.

8. Managing the Property

Now that you have a tenant occupying your property, it doesn’t mean that you can sit, relax and wait for the money to come in.

Property management involves:

- Handling tenancy leases

- Collecting monthly rent

- Sending late payment and eviction notices

- Inspecting the property before and after

- Arranging for payback of deposits after a tenant moves out

- Screening of new tenants

You can either choose to hire a property management company or do this by yourself. The fee will vary from one company to another, but will on average cost between 8-12% of your monthly rental income.

Additionally, you need to be proactive when it comes to repairs and fixtures to the property. Don’t wait for your tenants to call for you to check on the condition of the property. Have a list of handymen, plumbers, electricians who will do routine maintenance for your property. This also means if a tenant moves out, it becomes easier to find a new one.

In a Nutshell

Buying rental property is not a get-rich-quick scheme. You need to conduct proper due diligence before deciding to invest and be realistic about your expectations. It takes work and effort to get the financial freedom that comes with acquiring rental property.