Purchasing a new home is an exciting milestone but it can also be a complex process, especially when it comes to financing. Fortunately, our FREE and easy-to-use and online Home Loan Mortgage Calculator is here to streamline your home ownership journey. In this blog post, we’ll guide you through how to use the mortgage calculator tool. This will enable you to make informed decisions and discover the perfect mortgage for your dream home.

Table of Contents

Understanding the Mortgage Calculator

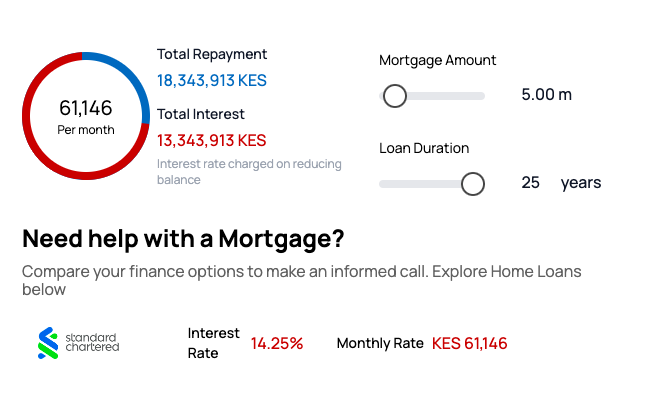

The Mortgage Calculator is a FREE, user-friendly online tool designed to help you estimate your potential mortgage payments. It takes into account factors like the loan amount, interest rate, loan term, and down payment. This will help to provide you with an accurate monthly payment amount. Before you start using the calculator, gather the necessary information. This information may include things such as the home price, down payment percentage, and loan term, to ensure precise calculations.

How the Mortgage Calculator Works

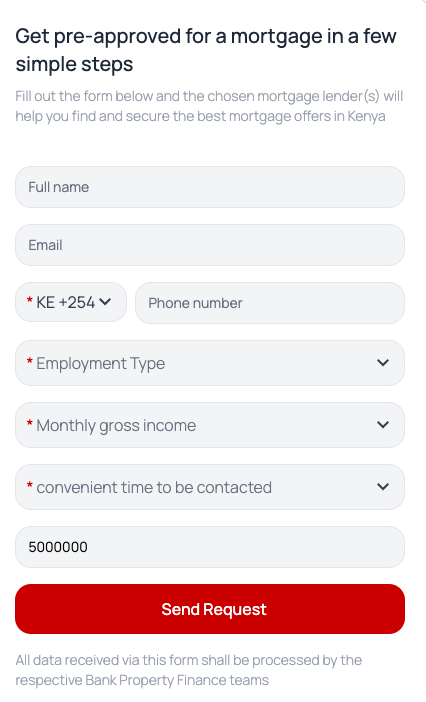

- Step 1: Enter Your Information: Provide details about your property needs to get personalized loan recommendations from our experts.

- Step 2: Fast Pre-Approval: Get pre-approved quickly to understand your borrowing capacity and streamline the home loan process.

- Step 3: Property Valuation: To ensure your property aligns with your loan amount a valuer approved from the bank will asses the property value.

- Step 4: Secure Conveyancing: A bank lawyer then handles the due diligence and legal title transfer.

- Step 5: Go After Your Dream Property: You can now confidently pursue the property you desire

Frequently Asked Questions

A mortgage calculator uses the information you give to present home loan options and estimates. This valuable tool proves beneficial in obtaining estimates for various types of mortgages you may qualify for. Understanding how different loan terms can impact your monthly payments.

Yes, mortgage calculators are generally accurate in providing estimates based on the data provided. However, for precise details, it’s essential to consult with a qualified mortgage lender or financial advisor. BuyRentKenya will link you with financial institutions who will provide you with advice to help you take the next steps with confidence.

Any person with a regular income from salary, existing rent or consultancy income.