- Emotions influence up to 90% of buying decisions in almost all industries.

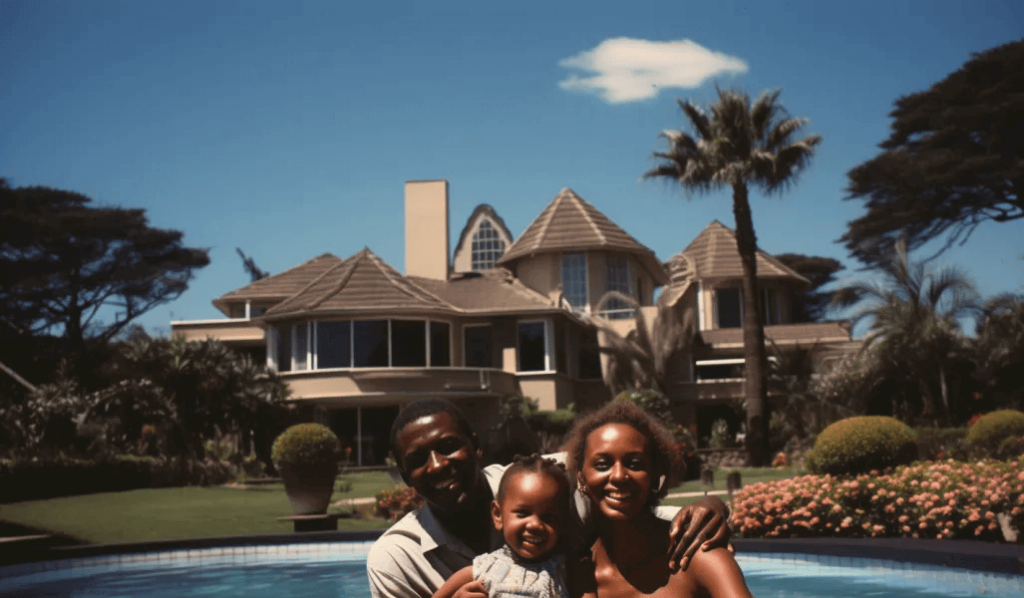

- A home buyer is more likely to buy the house when they feel emotionally connected to it.

- Nostalgia, memories, and future dreams play a key role in deciding whether to buy a house.

When buying a house, most buyers consider how the house looks, whether it will suit their family’s needs, whether they can picture themselves living in that house, and whether it has any features similar to a house they once lived in, such as a childhood home.

All these factors play a role in affecting emotional influence on property decisions.

Table of Contents

Is Buying a House Primarily an Emotional or Logical Decision?

While buying a house should be logical, emotional factors tend to overtake logical ones during decision-making. Most home buyers will consider the purchase’s financial aspect as the main logical component and base everything else on an emotional basis, which is one of the key cognitive biases in home buying.

READ ALSO: A Step-by-Step Guide to Buying a House in Kenya

How Do Emotions Influence the Process of Buying a Home?

The psychological aspects of home buying are based on both internal and external factors. A home buyer’s emotions can influence the purchasing process for several reasons;

- Emotional connection to a house

- Personal attachment to a place

- Fear of missing out on a good deal

- A desire to fit in or to avoid being left behind

- Desired lifestyle

- Closeness to family and friends

- Peer Influence from family, friends, or co-workers

- The property’s visual appeal

- A need for a sense of security

- Family well-being

- Achievements of one’s life goals

- Sense of pride

- Desire for stability

How Do You Balance Emotions and Logic When Buying a House?

Home buyers should exercise rationality in house-buying decisions to avoid impulse-buying homes due to emotional influence. This can be achieved by doing the following;

Identifying Must-Have Features and Amenities

Create a checklist of everything you want your house to have to enable you to choose a house that suits your needs. Additionally, ensure your potential home is near amenities that you need in your life.

Have a Budget

Evaluate your finances and determine the maximum amount of money you will spend on a house. This will prevent you from financially buying an extravagant house that is above your reach.

READ ALSO: A Beginner’s Guide to Mortgages When Buying a House

Seek Professional Guidance

Work with a mortgage advisor, real estate agent, or valuation expert to help reel you in if you go overboard. They will help to provide a professional perspective that may break you out of your emotional decision-making cycle.

READ ALSO: Important Property Development Team Members

Do A Property Analysis

This is similar to a SWOT analysis but mainly focuses on the pros and cons of buying a particular house. This will help you decide whether the house suits your needs and wants.

Inspect The Property

This mainly applies to pre-owned homes. Assessing the quality of a house will help you decide whether it is a financially viable option. You can do this by estimating how much you will need to upgrade, repair, and maintain the house. As well as consider its future resale value.

READ ALSO: Why Due Diligence is Essential in Property Transactions

Key Takeaway

Please do not rush into buying a house; visit it several times to assess its livability. You may buy a house only to find out the road nearby is too noisy, making it impossible to live there peacefully.

You should also consult family and friends to get their perspective. They will help you rationalize the buying process, which will help you buy the right house.

Lastly, do your due diligence before committing to anything. And remember, buying a house is expensive and should be logic-based rather than emotion-based.

READ ALSO: Building vs Buying a Home in Kenya: Which One is Cheaper?